Be Covered For Life!

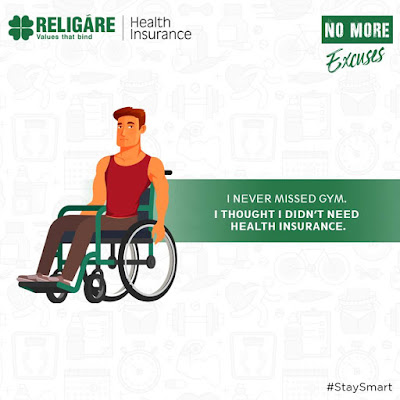

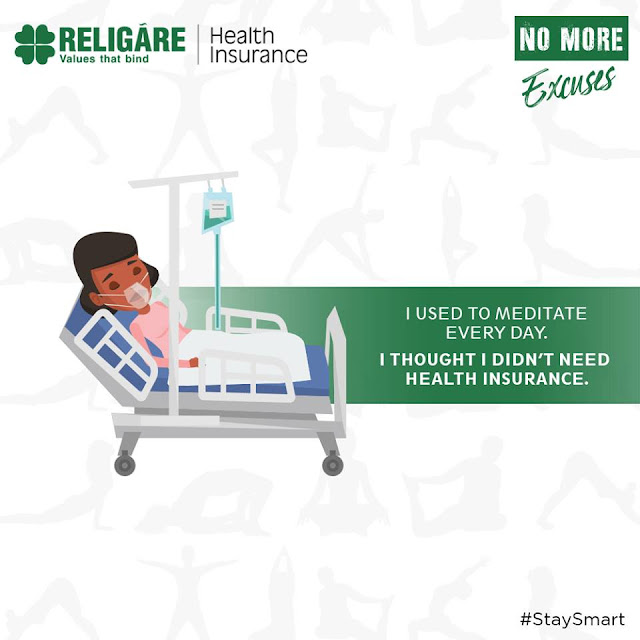

Life is fickle, and no one knows what is waiting for us just around the corner. Our life is undeniably unpredictability, and even though that is unnerving, it also makes us think about the oddities of life which may crop up out of the blue and be prepared to handle them adequately. A medical emergency can transpire at any moment and can result in a huge emotional and financial burden. In preparation for such situations, one should invest in a medical insurance which can lend you peace of mind as well as financial aid. Let us explore some of the key points one should be aware of while choosing a medical insurance. Flexibility: When it comes to health insurance, versatility is crucial, as the life of a person is never static and their needs change over time. The flexibility of a plan gives one a sense of authority over their family's health security, while still giving them the space to evolve. Easy settlement: Fast and smooth claim settlement is like a big sigh of relief